Hey there.

You know that awkward pause when someone asks “What’s your permanent address?” Maybe you end up giving them your parents’ house, or that apartment you technically still pay for but haven’t actually slept in for months. Or you just shrug and say “It’s complicated.”

Trust me, I’ve heard this story more times than I can count. You’ve built this incredible career helping people in hospitals from coast to coast. The money’s good, you’re seeing places you never thought you’d visit, and honestly? What you do matters. But the second you want to buy your own place, suddenly everyone treats you like you’re some kind of nomad who can’t commit to anything.

Here’s the thing though – you absolutely can buy a home. And no, you don’t have to give up traveling to do it.

Why the Nurse Mortgage Process Feels Frustrating

Let me tell you what’s really happening when you apply for a loan. While there’s more to it, here are three big things they focus on:

- Steady job history

- Verifiable, reliable income

- A stable permanent address

Numbers one and two? You’ve got those locked down better than most people I work with. Hospitals need you everywhere, and they pay accordingly.

But that third thing… yeah, that’s where it gets messy.

When lenders see you’ve had addresses and jobs in five different states over two years, they might get confused. It’s not that they think you’re bad at your job – they just like things steady. So when things look different, like moving around a lot, you may be asked more questions or to provide more paperwork to understand your story – that’s all it really means.

The No Permanent Address Issue Isn’t Just You

I work with a fair share of travel nurses in MD, DC, VA, WV, PA & FL. I’ve sat across from nurses who’ve worked in COVID units, helped out during natural disasters, kept rural hospitals running – and then watched them get turned down for mortgages. It’s frustrating because I know exactly how hard you work and how much you deserve to own something.

Lenders prefer things that look steady and constant on paper – like one address, one job, consistent income. So, when they see someone who moves often for work, like you, it doesn’t fit the usual checkboxes. It’s not they don’t value what you do – it just means we may need explain your situation a little more.

But here’s what I’ve figured out after doing this for years: once you know the right moves, getting approved becomes way less complicated.

Establishing A Permanent Address

Step 1: Nail Down Your Home Base

This is an important thing you’ll do, and it’s not as complicated as it sounds.

You need one solid address – your “home base” where important mail lands and where you file taxes. Could be:

- Your parents’ place (even if you moved out years ago)

- A rental you keep between assignments

A relative’s house where you forward mail

What matters is that this address gets your tax stuff, bank statements, insurance papers – the important documents. Think of it as your official address, even when you’re hardly ever there.

Step 2: Put Your Paper Trail Together

All those contracts, pay stubs, and tax forms you have floating around? Time to organize them into one solid pile that tells your story.

You’ll want:

- Nursing contracts from the past couple years

Every pay stub and W-2 (including that assignment you’d rather forget)

Letters from your agencies saying you’re reliable – and clarifying that your housing stipends are discretionary, meaning you can use them as you choose.

I know gathering all this feels tedious, but this paperwork proves something crucial: you don’t just earn well, you earn consistently. That consistency is what lenders actually care about.

Step 3: Write Your Own Story

This part might feel weird, but it works. You need to write a letter explaining what you do for whoever’s reviewing your loan.

Keep it simple:

- Explain why you move around (hospitals need you)

Include specific dates and locations from past assignments

Point out that your skills are in serious demand

Make it clear you’re ready to have a real home base

Most underwriters want to help you get approved, but they need to see how all the pieces fit together. They understand that travel nurses are essential, but they need your file to make sense within guidelines. Your letter helps them connect the dots between your mobile career and your financial stability so they can advocate for your approval.

I have more tips about Debt to Income Ratios here,

Step 4: Find Someone Who Actually Understands Your Situation

This is where I come in. Not every lender knows how to handle your type of income. Some see multiple W-2s, and think it’s inconsistent or short-term – when really, it just needs to be documented and explained. Remember – connect the dots!

Housing stipends are probably a big part of your earnings, and the good news is they can often be considered as income – if they’re discretionary. But how do you document that? This is where having someone who understands travel nurse pay structures makes a huge difference. I help match you with the loan that fits your actual life instead of trying to squeeze you into some cookie-cutter box.

Why Having Your Own Permanent Address Changes Everything

Look, I know you didn’t get into travel nursing to sit still. But owning a home doesn’t kill your freedom – it actually gives you more of it. Think about what this means:

- Your own space to decompress between tough assignments

A place you can decorate however you want

Building equity instead of making someone else rich with rent money - Picking a city you genuinely love and putting down roots there

And let’s be real – after dealing with a particularly rough assignment, coming home to a place that’s completely yours hits different.

When Everything Falls Apart at the Last Second

Last month I got this panicked call around 9:20 AM. It was a travel nurse, completely distraught. She was supposed to close on her home the very next morning. Everything had been lined up – she’d been working her lender for months. But then, out of nowhere, the underwriter that approved her loan left the company. A new underwriter stepped in, reviewed the file, and said she is not qualified. Just like that, the loan was set to be denied – the day before closing.

She and her loan officer were scrambling, trying to figure out what to do. Somehow, while searching for best travel nurse mortgage lenders, they found my number through a Google search and gave me a call.

I wasn’t licensed in her state, so I couldn’t take over the file, but I could listen. After speaking with them, I offered a few ideas for them to come up with a plan forward.

Sometimes it’s not about fixing everything but rather be a sounding board – as someone who understands how this kind of work and income can get misread. Sometimes, that’s what makes the difference: having someone who gets it and can help guide you the next steps.

You’ve Earned This

Here’s something I want you to really hear: You spend your days taking care of everyone else. You work crazy hours, handle situations most people couldn’t dream of, and make a genuine difference in people’s lives every single day.

You’ve more than earned the right to have something stable and beautiful that belongs to you.

If anyone’s told you that your career means you can’t own a home, they’re flat-out wrong. You just need someone who gets that your “unconventional” job is actually one of the most stable, essential careers out there.

Your lifestyle isn’t too complicated for homeownership. The system just needs to catch up with reality.

Let’s Make This Happen

I’ve worked with a fair share of travel nurses at every stage of a mortgage – from people just starting out to veterans with decades of experience. Some wanted a small condo in their favorite assignment city. Others wanted space for family to visit. Every single one of them thought it would be way harder than it turned out to be.

If you’re tired of paying rent on places that never feel like home and ready to build something for yourself, let’s talk. I’ll look at your specific situation and together, we come up with a gameplan that aligns with your goals.

You deserve to have a permanent address that’s yours – even if you’re not there every night.

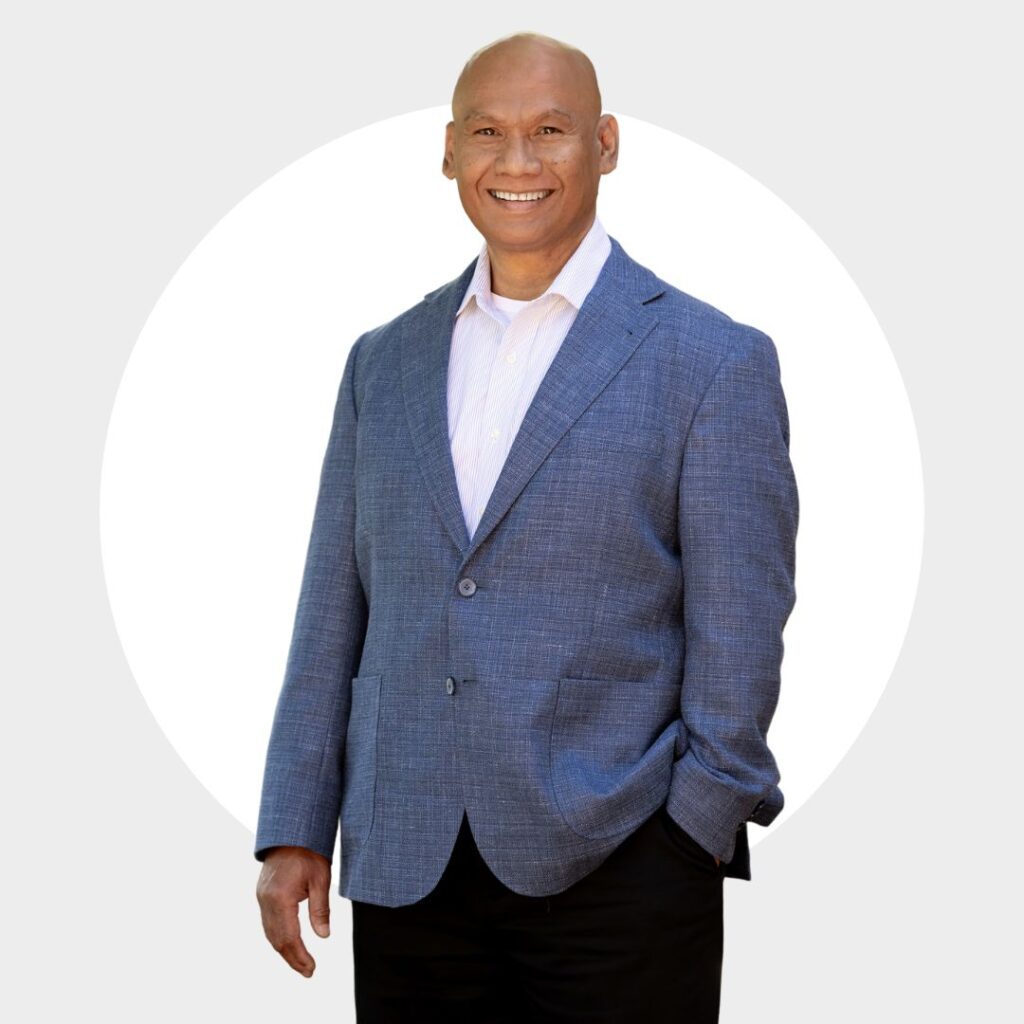

Ready to stop wondering and start doing? Contact me, Paul Defngin, today. Let’s get you pre-approved and create a plan that works with your life, not against it.

Why Choose Paul Defngin and The Yi Team for Your Home Loan?

- Expert Guidance for Travel Nurses: Paul has extensive experience working with travel nurses, so he understands your income structure and can present your financial profile in the best light. So if your home is in DC, Maryland, Virginia, West Virginia, Pennsylvania, or Florida, Paul is your guy!

- Custom Loan Options: Paul will help you explore loan programs that match your lifestyle and financial goals.

- Streamlined Process: Paul’s team is committed to making the mortgage process as smooth as possible, so you can focus on what matters—your career and finding the perfect home.

- PDefngin@TheYiTeam.com | 240-447-2376